NAICS Codes: A Complete Guide for Etsy Sellers in 2026

Learn which NAICS codes to use for your Etsy business, why they matter for taxes, loans, and business registration, plus a complete list of codes for handmade sellers, digital product creators, and vintage shops.

If you're an Etsy seller registering your business, applying for a loan, or filing taxes, you've likely encountered the term "NAICS code." These six-digit classification codes might seem like bureaucratic red tape, but choosing the right one matters more than you think.

In this guide, I'll explain what NAICS codes are, why Etsy sellers need them, and which specific codes apply to different types of Etsy businesses—whether you sell handmade jewelry, digital downloads, vintage items, or craft supplies.

💡 Quick Tip: Once you've set up your business properly, make sure you understand all the fees Etsy charges so you can price your products correctly and maximize profits.

What Are NAICS Codes?

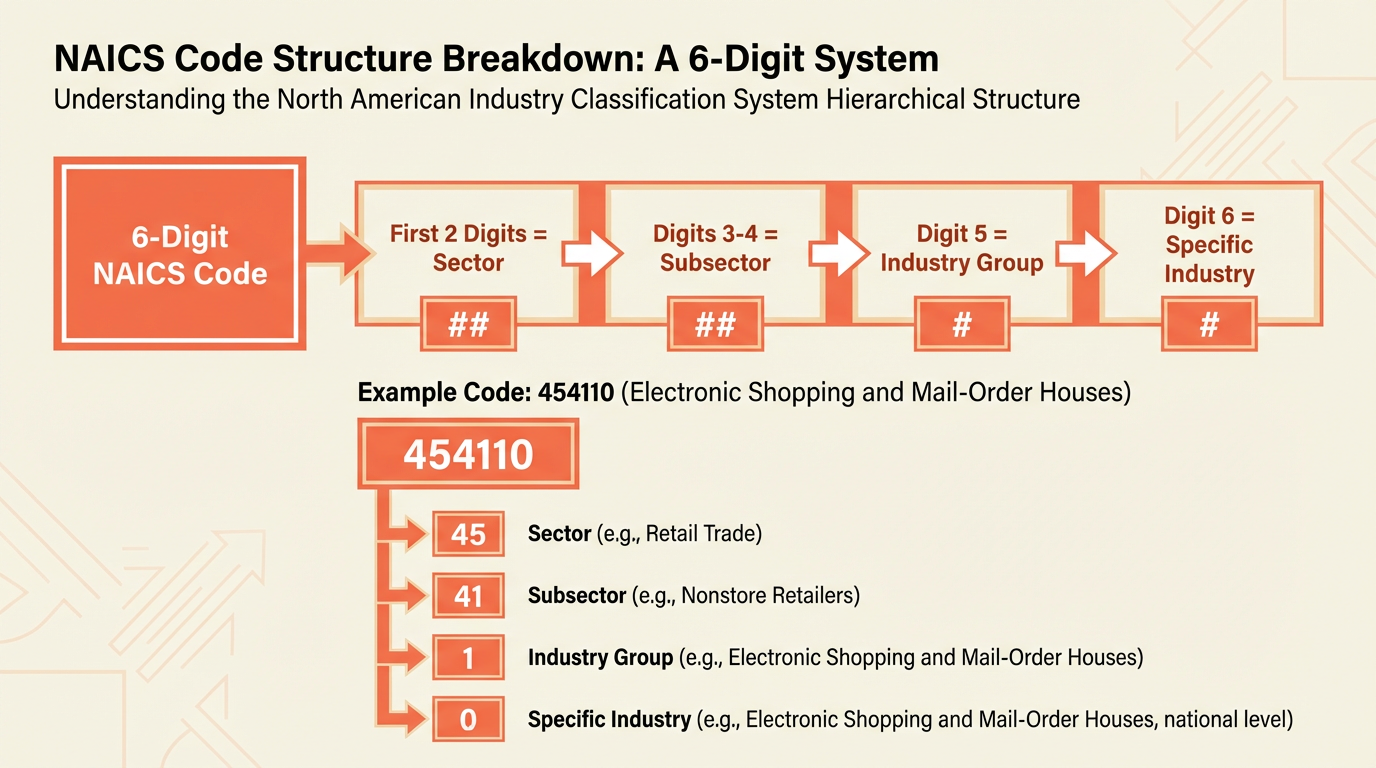

NAICS stands for North American Industry Classification System. Developed by the U.S. Census Bureau, these codes categorize businesses into specific industry sectors using a standardized six-digit numbering system.

Think of NAICS codes as a universal language that government agencies, banks, and other institutions use to understand what your business does. When you register for a business license, apply for an SBA loan, or file your Schedule C tax form, you'll typically need to provide a NAICS code.

Key points about NAICS codes:

- Developed and maintained by the U.S. Census Bureau

- Used across the United States, Canada, and Mexico

- Updated every five years (most recent update: 2022)

- Six digits: first two = sector, next two = subsector, fifth = industry group, sixth = specific industry

Why Do Etsy Sellers Need NAICS Codes?

As an Etsy seller, you'll encounter NAICS codes in several important situations:

1. Business Registration and Licensing

When registering your business with your state or local government, most applications require you to specify your industry using a NAICS code. This helps authorities understand your business activities and apply appropriate regulations.

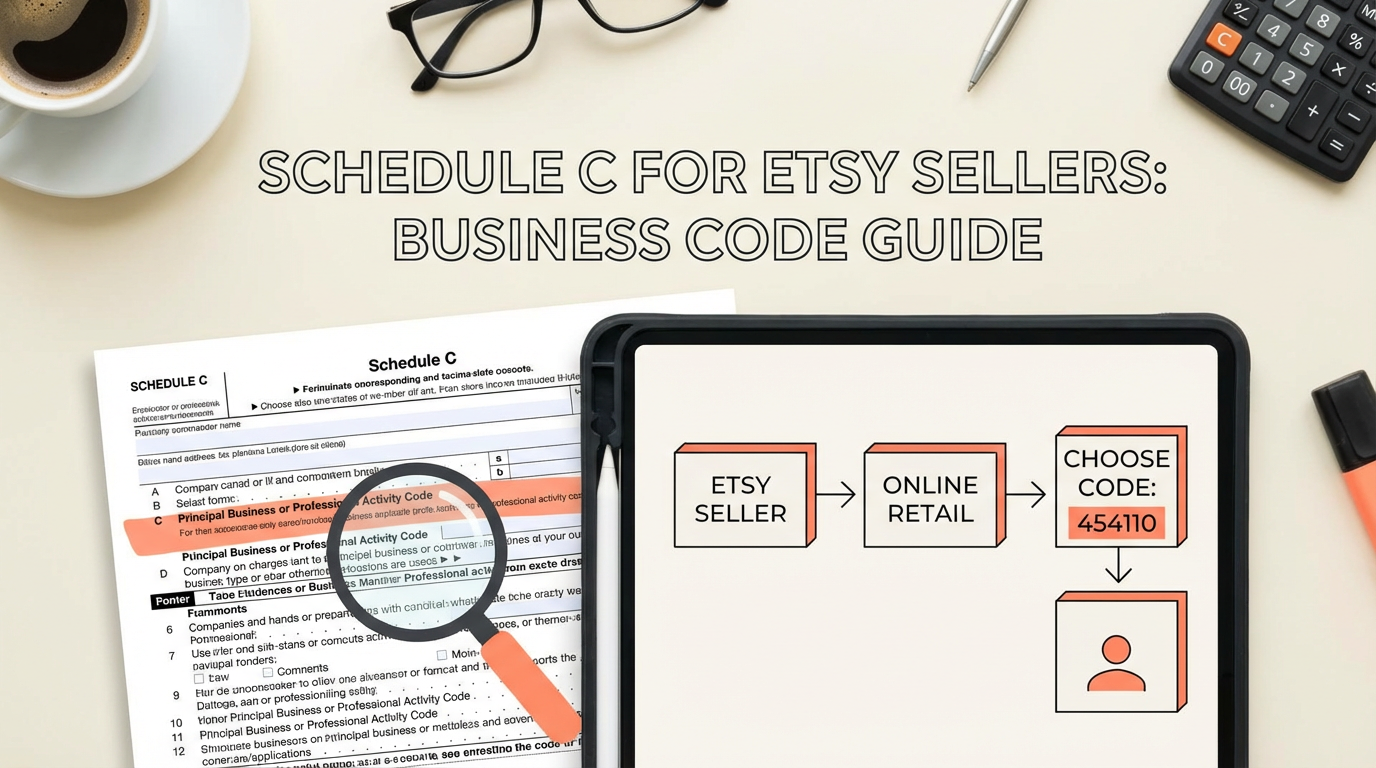

2. Tax Filing (Schedule C)

If you file taxes as a sole proprietor (which most Etsy sellers do), you'll need to enter a Principal Business or Professional Activity Code on Schedule C. While the IRS uses slightly different codes, they're based on the NAICS system.

3. Small Business Loans and Grants

The Small Business Administration (SBA) uses NAICS codes to determine eligibility for various programs. Your code affects:

- Loan program eligibility

- Small business size standards

- Government contracting opportunities

- Grant applications

4. Business Insurance

Insurance providers often use NAICS codes to assess risk and determine premiums. Having the correct code ensures you get appropriate coverage for your actual business activities.

Related: Business insurance premiums are just one cost of running an Etsy shop. Learn about Etsy's Offsite Ads fees and how they impact your bottom line.

5. Business Banking

When opening a business bank account, banks may ask for your NAICS code to categorize your business type and assess associated risks.

Best NAICS Codes for Etsy Sellers

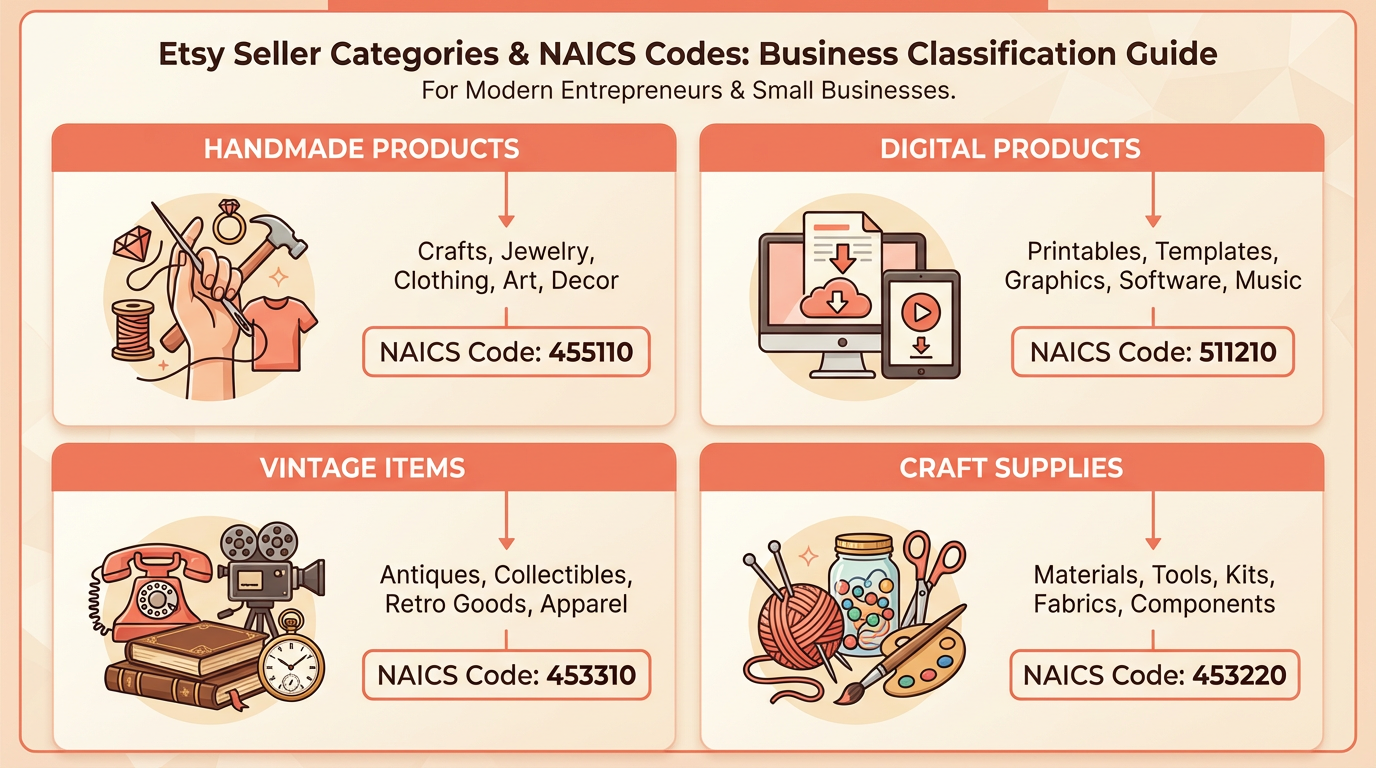

The "right" NAICS code depends on what you sell and how you sell it. Here are the most common codes for different types of Etsy businesses:

For Handmade Product Sellers

If you create and sell handmade goods (jewelry, clothing, home decor, art), these codes typically apply:

| NAICS Code | Description | Best For |

|---|---|---|

| 459910 | Pet and Pet Supplies Retailers | Handmade pet products |

| 459510 | Hobby, Toy, and Game Retailers | Handmade toys, games, crafts |

| 448150 | Clothing Accessories Retailers | Handmade jewelry, bags, accessories |

| 442299 | All Other Home Furnishings Retailers | Handmade home decor, textiles |

| 339910 | Jewelry and Silverware Manufacturing | Jewelry makers (manufacturing focus) |

Most common choice: Many handmade Etsy sellers use 459510 (Hobby, Toy, and Game Retailers) as a general catch-all for craft-based businesses.

For Digital Product Sellers

If you sell digital downloads (printables, templates, digital art, fonts, graphics):

| NAICS Code | Description | Best For |

|---|---|---|

| 519130 | Internet Publishing and Broadcasting | Digital content, downloadable products |

| 541430 | Graphic Design Services | Design-based digital products |

| 511210 | Software Publishers | Digital tools, apps, templates |

| 541922 | Commercial Photography | Digital photography, stock photos |

Most common choice: 519130 works well for most digital product sellers on Etsy.

For Vintage Sellers

If you specialize in vintage items (20+ years old):

| NAICS Code | Description | Best For |

|---|---|---|

| 453310 | Used Merchandise Retailers | Vintage clothing, collectibles |

| 459510 | Hobby, Toy, and Game Retailers | Vintage toys, collectibles |

Most common choice: 453310 (Used Merchandise Retailers) is appropriate for most vintage-focused shops.

For Craft Supplies Sellers

If you sell craft supplies, materials, or tools:

| NAICS Code | Description | Best For |

|---|---|---|

| 459510 | Hobby, Toy, and Game Retailers | Craft supplies, DIY materials |

| 424990 | Other Miscellaneous Nondurable Goods Merchant Wholesalers | Wholesale craft supplies |

For Online Retail (General)

These codes specifically address online/electronic retail:

| NAICS Code | Description | Best For |

|---|---|---|

| 454110 | Electronic Shopping and Mail-Order Houses | General online retail |

| 454390 | Other Direct Selling Establishments | Direct-to-consumer sales |

Important: 454110 is a popular choice for any Etsy seller since it specifically describes electronic/online retail, regardless of what products you sell.

How to Choose the Right NAICS Code

With multiple codes potentially applying to your business, here's how to choose:

Step 1: Identify Your Primary Activity

What generates most of your revenue? If you sell both handmade items and vintage goods, but 80% of your sales come from handmade jewelry, focus on the handmade category.

Step 2: Consider Manufacturing vs. Retail

If you make the products yourself, you might qualify for manufacturing codes (like 339910 for jewelry manufacturing). If you primarily resell items you source elsewhere, retail codes are more appropriate.

Step 3: Think About Your Business Goals

- Applying for SBA loans? Check which codes have favorable size standards

- Seeking government contracts? Certain codes may have set-aside programs

- Getting business insurance? Some codes result in lower premiums

Step 4: Use the Official NAICS Search Tool

The Census Bureau offers a free NAICS code lookup tool where you can search by keyword or browse by industry.

NAICS Codes for Schedule C Tax Filing

When filing your Schedule C (Profit or Loss From Business), you'll need a "Principal Business or Professional Activity Code." The IRS provides a list that closely mirrors NAICS codes.

Common Schedule C codes for Etsy sellers:

| Code | Description |

|---|---|

| 454110 | Electronic shopping and mail-order houses |

| 339910 | Jewelry and silverware manufacturing |

| 339930 | Doll, toy, and game manufacturing |

| 315000 | Apparel manufacturing |

| 453310 | Used merchandise stores |

| 711510 | Independent artists, writers, and performers |

Pro tip: If your business activities span multiple categories, choose the code that represents your primary source of income. Use our free Etsy Fee Calculator to see exactly how fees affect your profit margins for tax planning purposes.

Common Mistakes to Avoid

1. Choosing a Code That's Too Broad

While 454110 (Electronic Shopping) technically covers any online seller, more specific codes may be more beneficial for loans, grants, or insurance purposes.

2. Changing Codes Frequently

While you can update your NAICS code if your business model changes, frequent changes can raise flags with lenders or tax authorities. Choose carefully from the start.

3. Using Manufacturing Codes When You're a Retailer

If you resell products made by others (even if you customize them), retail codes are typically more accurate than manufacturing codes.

4. Ignoring State-Specific Requirements

Some states have their own classification systems or require specific codes for certain permits. Check your state's requirements when registering.

NAICS Codes and Small Business Size Standards

The SBA uses NAICS codes to determine "small business" size standards, which affect eligibility for loans, contracts, and programs.

Size standards vary by industry:

| NAICS Code | Industry | Size Standard |

|---|---|---|

| 454110 | Electronic Shopping | $40 million annual receipts |

| 339910 | Jewelry Manufacturing | 500 employees |

| 453310 | Used Merchandise Stores | $8 million annual receipts |

| 519130 | Internet Publishing | $47 million annual receipts |

Most Etsy sellers easily qualify as "small businesses" under any applicable standard, but knowing your size standard matters if you're pursuing SBA loans or government contracts.

How to Update Your NAICS Code

If your business evolves and a different code becomes more appropriate:

- Update state/local registrations: Contact your secretary of state or local licensing office

- Update tax filings: Use the new code on your next Schedule C

- Notify your bank and insurance: Update your business profile

- Document the reason: Keep records of why you changed codes

Frequently Asked Questions

Q: Can I use multiple NAICS codes for my Etsy business?

A: Yes, businesses can have multiple NAICS codes if they engage in different types of activities. However, you'll typically need to designate one as your "primary" code for most purposes.

Q: What if no NAICS code perfectly describes my Etsy business?

A: Choose the code that most closely matches your primary business activity. When in doubt, 454110 (Electronic Shopping) is a safe choice for any online seller.

Q: Do I need to register my NAICS code somewhere?

A: NAICS codes aren't "registered" centrally. You simply use the appropriate code when required on forms, applications, and tax documents.

Q: Does my NAICS code affect my Etsy shop directly?

A: No. Etsy doesn't use NAICS codes internally. These codes matter for external purposes like taxes, banking, loans, and government filings.

Q: How often do NAICS codes change?

A: The system is updated every five years. The most recent revision was in 2022. Changes typically involve adding new industries or consolidating outdated ones.

Q: I sell both handmade items and digital products. Which code should I use?

A: Use the code that represents your primary revenue source. If 70% of your income comes from handmade jewelry, use a handmade/jewelry-related code.

Quick Reference: Top NAICS Codes for Etsy Sellers

Here's a quick-reference table of the most commonly used codes:

| If You Sell... | Consider This Code | Description |

|---|---|---|

| Any products online | 454110 | Electronic Shopping and Mail-Order Houses |

| Handmade crafts/items | 459510 | Hobby, Toy, and Game Retailers |

| Handmade jewelry | 339910 | Jewelry and Silverware Manufacturing |

| Digital products | 519130 | Internet Publishing and Broadcasting |

| Vintage items | 453310 | Used Merchandise Retailers |

| Handmade clothing | 315000 | Apparel Manufacturing |

| Art/creative work | 711510 | Independent Artists, Writers, and Performers |

Conclusion

NAICS codes may seem like minor administrative details, but choosing the right one can impact your tax filing, loan applications, insurance rates, and business registration. As an Etsy seller, you have several options depending on whether you sell handmade goods, digital products, vintage items, or craft supplies.

Key takeaways:

- 454110 (Electronic Shopping) is a safe, general choice for any online seller

- More specific codes (like 339910 for jewelry makers) may provide benefits for loans or contracts

- Choose based on your primary revenue source if you sell multiple product types

- Keep your code consistent across tax filings, registrations, and applications

Take a few minutes to select the right NAICS code for your Etsy business—it's a small step that can make administrative tasks much smoother down the road.

Related Resources

- Complete Etsy Fee Breakdown for 2026 — Understand all Etsy fees including listing, transaction, and payment processing

- Etsy's Offsite Ads Fee Explained — Learn how Offsite Ads fees impact your profitability

- Etsy Fee Calculator — Calculate your exact profit after all fees

- Pinterest Marketing for Etsy Sellers — Avoid common mistakes when driving traffic to your shop

Sources

This guide references official government resources and industry expertise:

- North American Industry Classification System (NAICS) – U.S. Census Bureau official NAICS documentation and search tool

- Basic Requirements for Federal Contracting – U.S. Small Business Administration guide on NAICS codes and size standards

- Schedule C Principal Business Codes for Handmade Sellers – Craftybase's comprehensive guide to tax codes for crafters

- What is the NAICS Code? – FAMR explanation of NAICS code structure and usage

- NAICS Code Description Database – NAICS.com code lookup and descriptions

- Which NAICS Codes Get the Most Funding? – Nav's analysis of NAICS codes and business funding

Last Updated: January 23, 2026

Category: Etsy

Reading Time: 10 minutes

Found this guide helpful? Share it with fellow Etsy sellers who are setting up their business or filing taxes!